Transaction Sales- POS- Coupon

Overview

On the Sales Screen, there is a drop down to display transaction level coupon codes which are available to be used on the transaction (expired coupons are excluded from the drop down list). The coupon amount will be deducted from the total sale, it applies on a transaction level. The coupon amount will be reported in Media Tender reports on the POS and included in the Real Time Sales Report on CAS. Note - the full amount of the sale will be taxed, if applicable (the coupon amount will not be deducted prior to calculating sales tax, as it done on the item level coupons).

Details

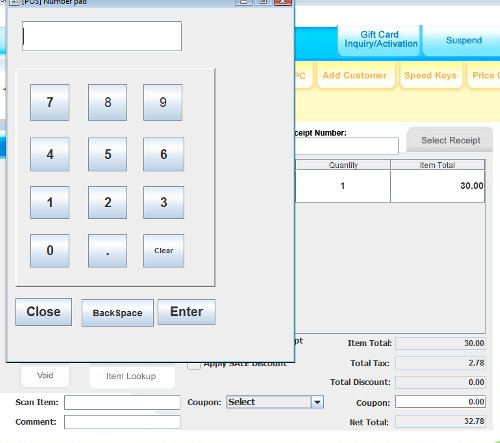

Transaction Level

Transaction level coupons are applied to the transaction total. Transaction level coupons can be selected from a drop down similar to a discount drop down or added in using the amount. Transaction level coupons will be treated as cash tender and will report as such.

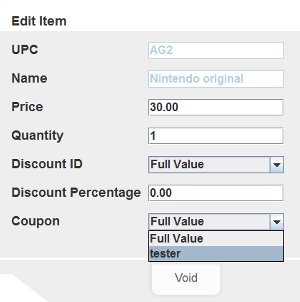

Item Level

Item level coupons can be added to single items when using the drop down feature. So coupons will have to be created on the CAS before. Coupons used here will be noted as a coupon transaction and noted under coupon transaction report.

How are discounts and coupons taxed?

Line item coupons and all discounts are treated as a reduction in the selling price. If a price is listed as $20 and there is a line item coupon of $1 or a discount of any kind the taxable amount is reduced by the coupon/discount before the tax is calculated.

Transaction level coupons are treated as tender so the tax calculation is before the deduction.

Access

Is at a POS level, for POS users.