Store Credit - STS

Overview:

Many merchants implement policies regulating the process of store credit. One example in utilizing the store credit includes merchants who have return policies involving store credit for returned items. When the customer returns the item(s) to the store, the merchant can record the retail value back into the system. The system can process the credit and apply it to a gift card.

There are a couple of steps to make this happen. First, you need a physical supply of gift cards. Our recommended vendor is Smart Transaction System (STS), a Gift Card gateway that takes care of the security of Gift Cards and verifies authorization security aspects. STS assists in creating customer accounts with their corresponding gift card purchase.

A service item needs to be created on CAS (call the item "Gift Card")

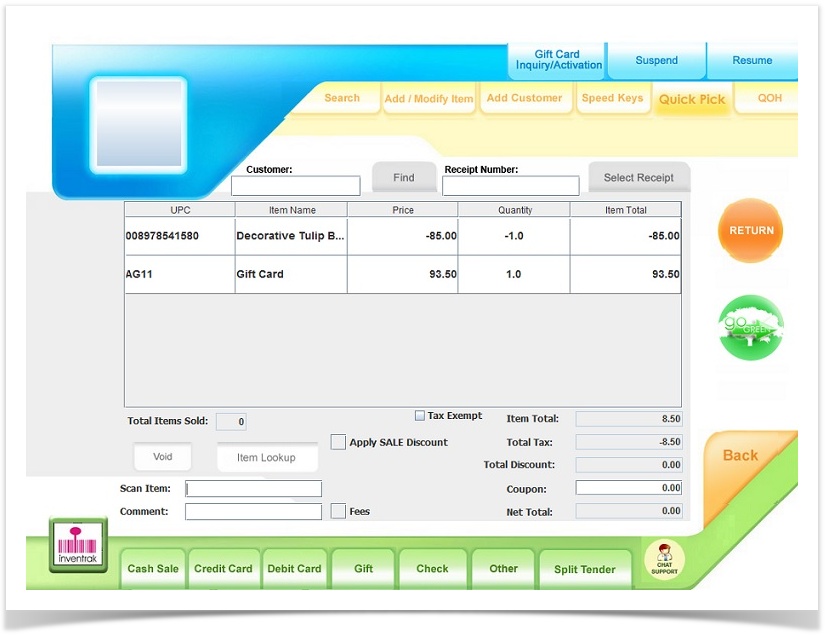

When an item is returned, the cashier rings up the items as a refund then sells a gift card (the service item created above) in the same sales transaction for the desired amount. This is a net sales of $0 or a positive amount if they are also buying other items. The gift card then needs to be activated at the register. Now the customer has received their money back on their return on the gift card, which can be used for future purchases.

Steps without STS

1-You can create a service item called gift certificate on the CAS

2-when someone that wants a gift certification comes in, you ring up that item, and give them the receipt.

3-The customer comes back with the same reciept and then you do an exchange transaction. (ring up as a sale the item that they want to buy and then hit the green return button. Lookup the transaction number and select the gift receipt for the return)

Note* You would have to manually keep track of the amount

4- You can take the receipt from the client, and then resell the gift certificate with the new balance and then give them new receipt with the new balance. Another option is to give them a paper certificate with the transaction number written on the certificate.