Transactions - Refund Transactions - CAS

Overview

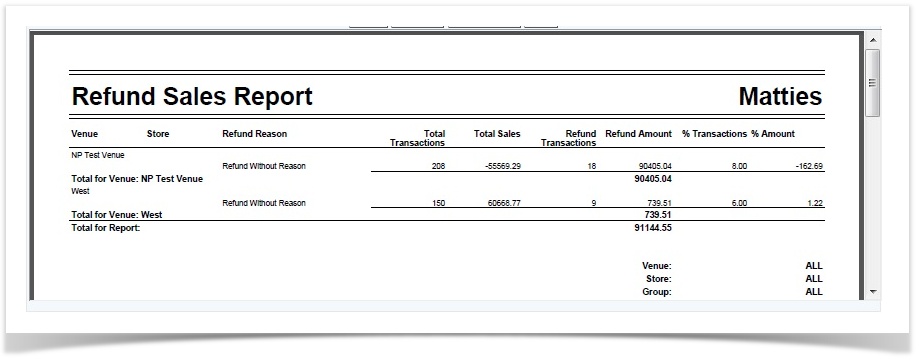

This report provides information about refund transactions by reason code. Use it to monitor the percentage of refunds.

Handy Hint

Review your activity at similar type stores to see if an unusual refund activity is occurring, you can do this by running the report and consolidating by venue or store. You may want to review your refund policy if this number is excessive. Some customers elect to not offer cash refunds and only provide them on gift cards.

You may also elect to require that all transactions be verified against original sales receipts if you are concerned about the validity of refunds.

Details

User provides details and generates a refund sales report. User specifies the report by the venue, store, group, or register, and then provides details such as department, size, and the date range which the sales are to be reported.

The user then can generate the report or download the CSV file. The generated report provides the venue, store, refund reason, total transaction price, total sales, the number of refund transactions, the total refund amount, the percent refunds of all transactions, and percent refunds of sales amount.

Total Transactions- Total number of sales transactions with and without refunds associated with them

Total Sales- Dollar amount of all sales (net amount including tax) Sales (+ tax) - refunds (- tax)

Refund Transactions- Number of Refund Transactions

Refund Amount- The Amount of Refund Transactions (this includes sales tax)

% Transaction- The percent of Refund Transactions (Refund transactions/Total transactions)

% Amount- The percent of the Refund Amounts (Refund $/Total $)

Access

Access to this function at an enterprise level is limited by default to the System Administrator and Financial users only. Accounting, store managers, warehouse general managers as well as zone managers and human resource managers may view refund transactions report at Venues or Store assigned to them.