Sales - Sales Tax Settlement - CAS

Overview

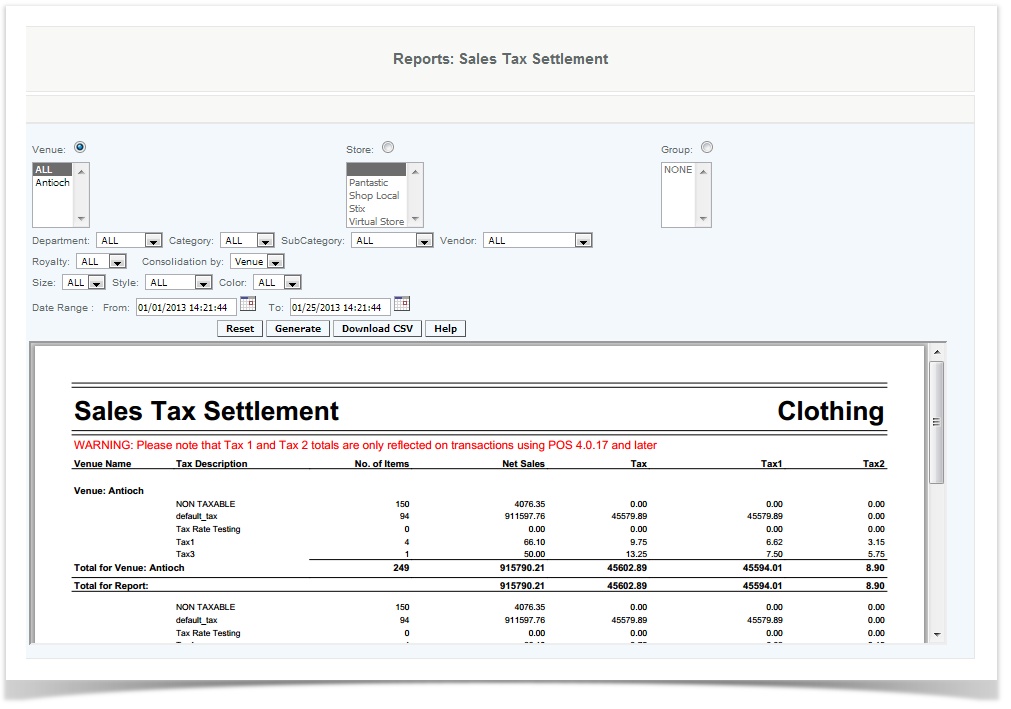

This report provides a summary by tax codes of the number of items sold as well as the net sales and tax amount. This report can be used to aid the merchant in their tax remittance information.

Warning

The report is based in historical data on version 3.5 and above

Details

User provides details and generates a sales tax settlement. User specifies the report by the venue, store, group, and then provides details such as department and size, and selects consolidation by venue or store and the date range which the sales are to be reported.

The user then can generate the report or download the CSV file. The generated report provides the venue name, tax description (taxable, nontaxable, or exempt), number of items, net sales, tax 1, and tax 2 (if applicable).

Some municipal jurisdictions support two tax rates for certain products (typically liquor tobacco etc), or as in the case on New York City there are state and local taxes of which local taxes are waived during one week of the year. This allows the system administrator to manage the two rate tables if needed. The rates are calculated linearly or they can be compounded if required. For example suppose an item is sold for $100 and the tax rates are 10% and 2%. If linear the tax would be calculated as tax =($100 * (10% +2%))= $12 if compounded it would be tax =((($100*10%)+100)*2%)-100)=12.20.

Additional Data:

Data is populated on this report from the postransactions and postransactionsitemdetails tables.

Access

Access to this function at an enterprise level is limited by default to the System Administrator and Financial users only. Accounting, store managers, warehouse general managers as well as zone managers may view sales tax settlement report at Venues or Store assigned to them.