Creating or Modifying Employee Payroll Records

Overview

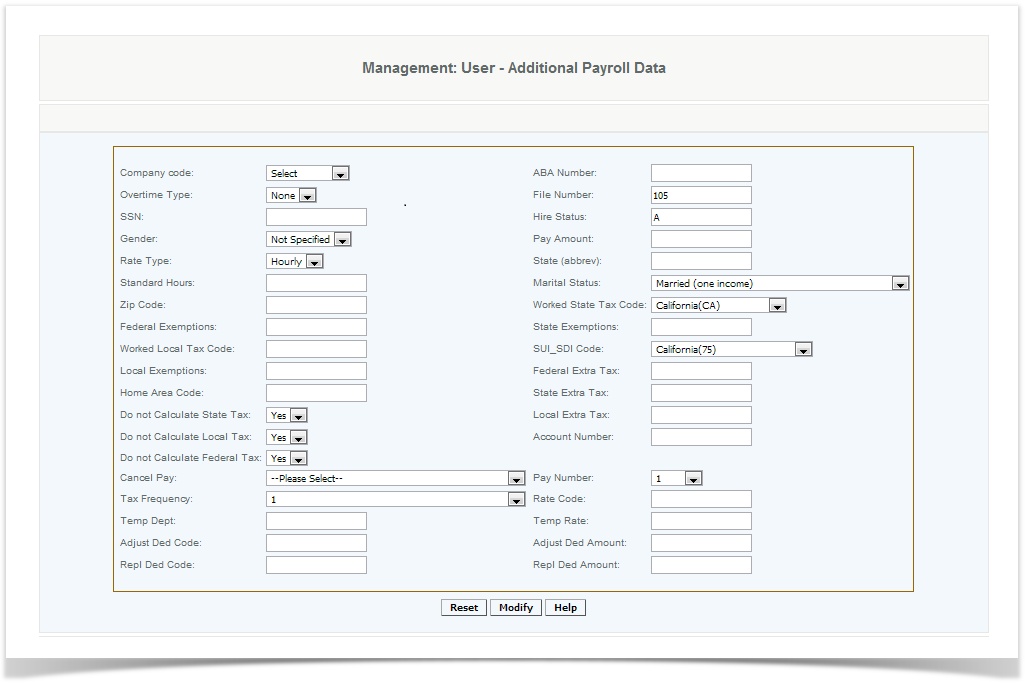

This is a payroll settings screen used only if the system administrator has elected to track employee payroll. The user has the option to click "Create and Next" after creating an employee to access this screen. This information will be used for payroll records.

Details:

Be Careful

Do not attempt inputting any of this data, without consulting your payroll provider.

Company Code is a field you can select from a drop-down of options based on the the cost center codes that were configured in the Employee Payroll Settings section.

ABA Number Alpha-numeric value with no upper limit. This is a nine-digit numeric code created by the American Bankers Association that identifies an employer's bank and routing for electronic transactions.

Overtime Type is selected from the drop down values, which are populated based on the overtime rules enabled in the Company code setup.

File Number Is a system generated number, and increments by 1, however it can be modified to meet any existing employee file numbers. It should be between 55-99999 only, so if the generated number is below 55 please modify it

SSN The social security number must be entered as 11 numbers with dashes

Hire Status Please consult your payroll provider for instructions.

Gender Please make a selection from the drop down.

Payment Amount This field can be up to 5 numeric digits only. The payment rate to the employee is set here.

Rate Type Please select a value from the drop down. The rate type is the basis for the previously mentioned Payment Type.

State Please enter the State Abbreviation for the particular state using caps. Lower case entries will display an invalid data error message

For Standard Hours please consult your payroll provider for instructions.

Marital Status Please make a selection from the drop down.

Zip Code Please enter the 5 digit zip code for the employee.

Worked State Tax Code Please consult your payroll provider for instructions.

Federal exemptions Please consult your payroll provider for instructions. This is up to 2 digit number only The total number of federal tax exemptions for the employee is listed here.

State Exemptions Please consult your payroll provider for instructions. This is up to 2 digit number only The total number of federal tax exemptions for the employee is listed here.

Worked Local Tax Code Please consult your payroll provider for instructions. This value can be up to 4 digits only.

SUI SDI Code Please consult your payroll provider for instructions. You may select a value from the drop down in the system.

Local Exemptions is where the local tax exemptions of the employee can be set here. Please consult your payroll provider for instructions.

For Federal Extra Tax please consult your payroll provider for additional instructions.

In the Home Area Code,the 3 digit area code of the employee is entered here.

For State Extra Tax please consult your payroll provider for additional instructions.

For Do Not Calculate State Tax make a selection from the drop down in the system Yes or NO. Please consult your payroll provider for additional instructions.

For Local Extra Tax please consult your payroll provider for additional instructions.

For Do not Calculate Local Tax make a selection from the drop down in the system Yes or NO. Please consult your payroll provider for additional instructions.

The Account Number is a up to 16 digit account number of the employee. Typically this in conjunction with the ABA is used for ACH deposits or prepaid card information. Please consult your payroll provider for instructions.

For Do not calculate federal Tax make a selection from the drop down in the system Yes or NO. Please consult your payroll provider for additional instructions.

For Cancel pay please consult your payroll provider for additional instructions.

For Tax Frequency please consult your payroll provider for additional instructions.

For Rate Code please consult your payroll provider for additional instructions.

For Temp Department please consult your payroll provider for additional instructions.

For Temp rate please consult your payroll provider for additional instructions.

For Adjust Ded Code please consult your payroll provider for additional instructions.

For Adjust Ded Amount please consult your payroll provider for additional instructions.

For Repl Ded Code up to 2 numeric values only Company's replace deduction code.

For Repl Ded Amount please consult your payroll provider for additional instructions.

Access

Employee Payroll Records can only be set or modified by users whose roles have been defined as System Administrator, Financial, HR Manager, Venue/Regional Managers, Store mangers or Zone/District Managers. Users may not modify their own records.